This post was sponsored by Purchasing Power as part of an Influencer Activation for Influence Central. All opinions expressed in my post are my own.

When you have family members that are retired from the military, wouldn’t it be awesome if there was a way that they could afford major purchases without having to break the bank? Recently, I learned about Purchasing Power, a special benefit for military retirees and civilian federal government employees/retirees that helps with emergencies and large purchases, and there was no way I wasn’t going to share with you.

Here’s the scoop on Purchasing Power and why you need to share with your military friends and loved ones, pronto!

Even if I wasn’t receiving compensation for this post, Purchasing Power is such a great feature I’d be sharing it with you anyway! I’m a proud military brat. In fact, I spent most of my early years in Northern Maine while my father was enlisted in the United States Air Force. I loved living on a military base: it felt safe, secure, and comfortable. And, while living there, I also know what it was like to live on a fixed income.

Sure, my family was well taken care of (paid utilities and rent) and my parents paid for things like phone and cable, but with a house of four my parents scrimped at times, especially when we needed a new television or the fridge broke and needed to be replaced.

Fast forward to when my father retired, and we lived on his military pension until he found a suitable job. Moving a thousand miles from my “home” and needing to make major purchases for our new home was a must. And now that he’s fully retired, he’s back to having a fixed income.

While he does try to save as much as he can in case of emergencies, having to put large items on his credit card has happened. Back then, there was no way of paying for big expenses apart from our savings account, taking out a loan, or using a credit card.

And with credit cards, if they’re not paid off in the same billing cycle you made your purchases, big interest can be incurred. These days, there’s another way to pay for major purchases for retired military: Purchasing Power. Here are all of the details you need to know.

What Is Purchasing Power?

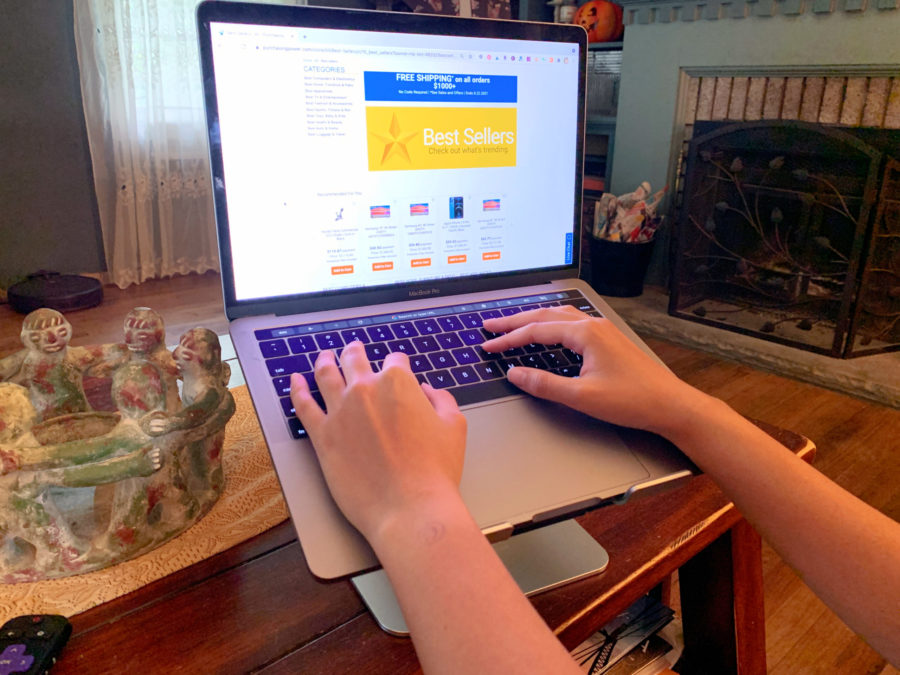

In a nutshell, it’s a special program for military retirees as well as federal civilian employees and retirees. Purchasing Power has its own online store (with over 40,000 products to choose from!) and, once you’re signed up and approved, payments are taken straight from your paycheck or retirement benefits with a buy now, pay later style of purchase.

You’ll receive your products up front, too, so it’s not like layaway. Plus, since the payments are automatic, you don’t need to worry about missing one accidentally. Members can choose up to 12 payments and incur zero interest or hidden fees.

Additionally, there are no hidden credit checks to worry about. So, essentially, your job is all the credit you need. If you like stats, Purchasing Power is trusted by over 150,000 federal civilian employees, retirees, and military retirees.

What Kind of Brands Are in the Purchasing Power Store?

That was a big question for me. If I’m putting my seal of approval on it, I need to make sure the brands aren’t obscure ones, but those I recognize and trust. So, I did a little digging on the official website and found plenty of big name brands including Dell, Sony, & Nintendo Switch in electronics. As for appliances, it sells Samsung, GE, KitchenAid, and more.

So, say the kiddo needs a new computer or gaming device – it’s a no brainer to choose Purchasing Power. And if you were thinking about splurging on a vacation or some high-end fashion, the Purchasing Power website has plenty to choose from, too.

How to Qualify for Purchasing Power

If you meet these eligibility requirements, you’re good to go:

● You must be a current employee or annuitant of the FEDERAL GOVERNMENT/POSTAL SERVICE

● If you’re a current employee, you must have worked for your organization at least 6 months

● You must have a bank account or credit card. The only time your credit card would be charged would be in case of non-payment via payroll allotment

● You must earn at least $20,000 a year

● You must be at least 18 years of age

● You must be retired military. Active duty are not able to participate at this time.

Once you’ve shown proof, you’ll receive a spending limit and can begin making purchases. FYI: shipping charges will apply, but keep reading below to find out how to save on your first purchase PLUS get free shipping!

Purchasing Power Savings Code for First-Time Buyers

Okay, you’re all signed up and ready to go. Now, how can you save on your first purchase? Use the code 25GOVSHOP to take 25% off your first purchase AND receive free shipping. That’s a great deal!

Leave a Reply