We all dream of that perfect vacation: sunshine, relaxation, and unforgettable memories. However, unexpected events can turn that dream into a stressful nightmare (trust me on this one, I’ve been there.) Trip cancellations, medical emergencies, and lost luggage can wreak havoc on both your finances and itinerary. This is where travel insurance comes in as a safety net, offering peace of mind and financial protection. Here are five reasons why travel insurance is a good idea for any trip and how to find the best one to suit your travel needs.

First, What Type of Travel Insurance Do I Need?

Just like any kind of insurance, figuring out what type you need can be confusing. To give you the “tell it to me like I’m five years old” lowdown, here are the basics:

First, travel insurance covers unforeseen and unexpected events 24/7. Reasons for needing travel insurance include cancellation, trip interruption, travel delays, medical emergencies, and emergency medical transportation, and baggage delays and losses.

When you purchase a travel insurance plan, make sure you have one that suits your needs, whether it’s for one trip or for an entire year’s worth of travel – yes, there are policies for that, too.

Allianz Travel Insurance and Allyz TravelSmart App

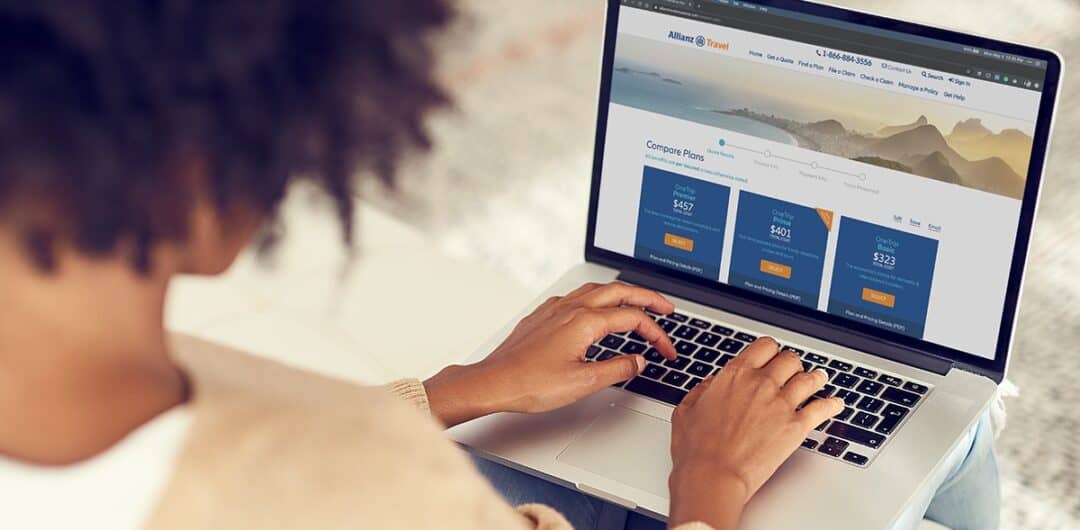

So, let’s talk about dependable travel insurance. I’ve been a massive fan of Allianz Travel Insurance for years. Why? The answer is simple. The company has an amazing track record, offers users plans based on travel needs and budget, and you can speak to someone anytime you need to, aka, 24 hours a day, seven days a week. Get sick at three in the morning while traveling? You can speak to someone live. Allianz makes travel as simple and worry-free as possible. Additionally, once you make a plan purchase with Allianz, you’ll have at least 15 days to review or cancel if you change your mind.

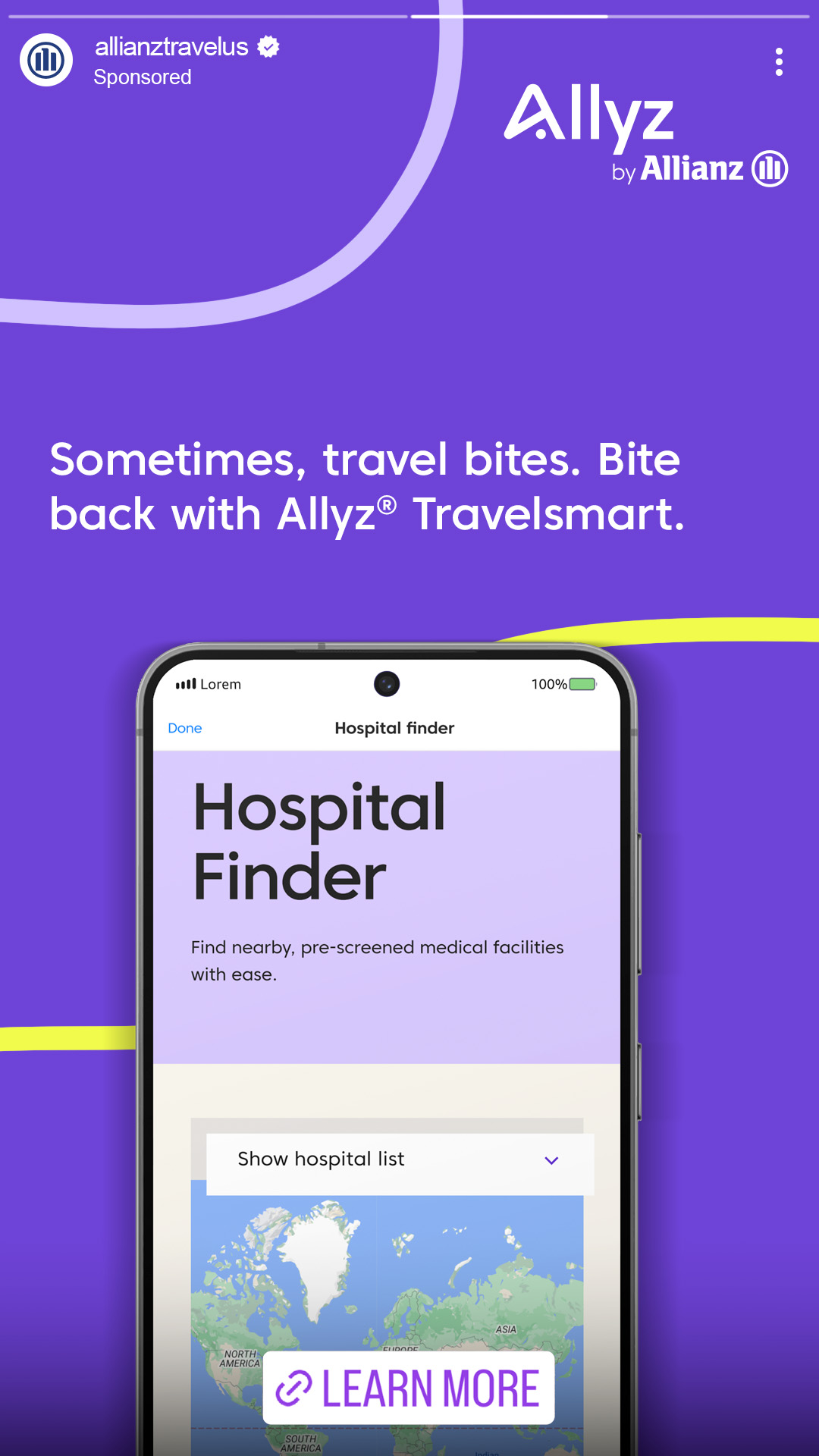

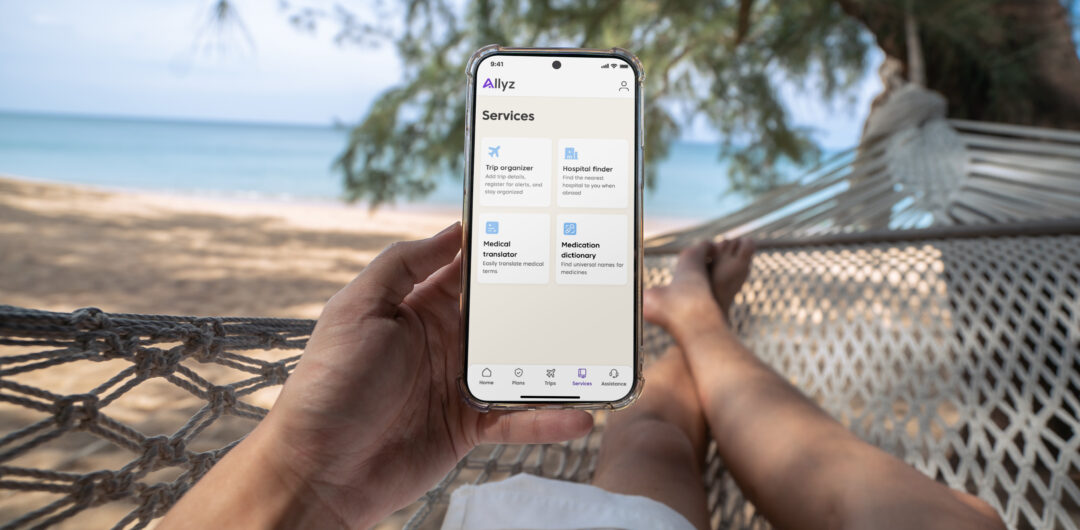

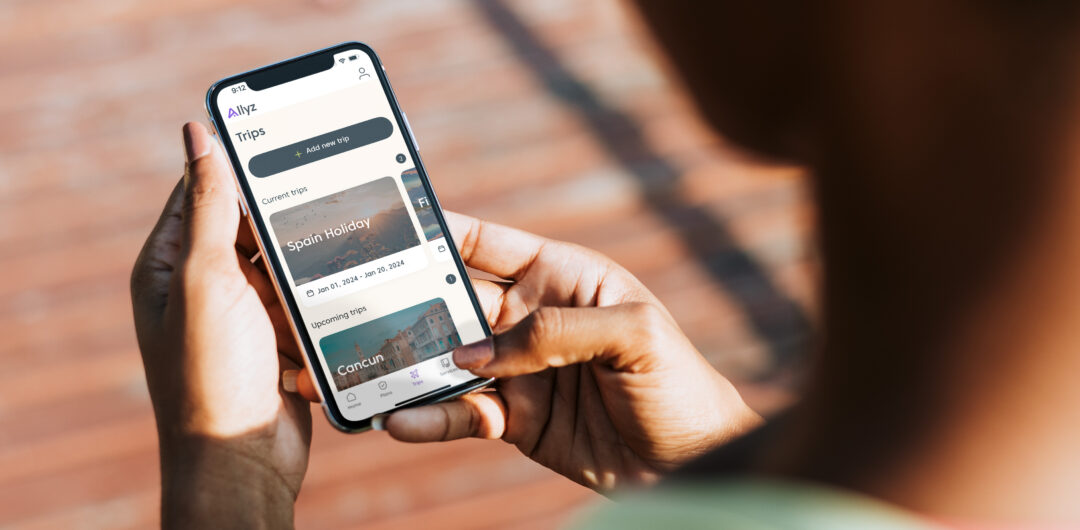

Keeping with the “simple” theme, to make things even easier, Allianz has a new free-to-download app. Called Allys (ah-LEEZE), it’s the updated, easier version of its previous TravelSmart® app. It provides practical services with a user-friendly interface that’s simple and easy to access. If you already have the TravelSmart® app, it will automatically update to reflect the new name, Allyz with the next update.

Additional features include:

- The ability to file a claim straight from your phone

- Get in touch with customer care for service and questions

- View your coverage details

- Manage travel plans

- Translate common medical terms

- Get safety and security alerts for your specific destinations

- Locate hospitals

- Organize travel itineraries

1. Travel Insurance Covers Trip Cancellation or Interruption

Life throws curveballs, and sometimes you need to cancel your trip due to illness, injury, or unforeseen circumstances. Travel insurance with trip cancellation coverage reimburses you for prepaid, non-refundable expenses if you need to cancel for a covered reason. This could include anything from a family emergency to severe weather at your destination.

I had to cancel my travel plans when my father was very ill a few years ago. While I was able to make arrangements further down the road, travel insurance would have covered them if I wouldn’t have been able to.

2. It Covers Medical Emergencies Abroad

Medical care can be expensive, especially if you’re traveling outside of your home country. Most regular health insurance plans offer limited or no coverage overseas, and this is something you’ll want to check way in advance of your vacation. I frequently visit Canada as I have family there and, should I ever get sick, it would be an out-of-pocket expense for me if I’m unable to quickly head back to the U.S.

Travel insurance with emergency medical coverage can help you pay for doctor visits, hospital stays, and even medical evacuation in case of a serious accident or illness.

3. Travel Insurance Covers Lost, Stolen, or Delayed Luggage

Airlines misplace luggage all the time; I had it happen to me on the way home from my wedding in Las Vegas! When checking the luggage carousel at Pittsburgh International Airport, Mr. Locke’s bag was waiting for him and mine (with my wedding dress) was MIA. There was another happily ever after when it showed up on my front porch a couple of days later.

Travel insurance with baggage coverage can reimburse you for essentials you need to purchase while waiting for your delayed bags to arrive. It can also offer compensation if your luggage is lost or stolen altogether.

4. Travel Delays

Flight cancellations or delays can not only disrupt your travel plans, they can cost you money. Again, using my own travel tales as a what-if, but there was a time when I was flying back into the U.S. from Mexico and my flight from Dallas International Airport actually left early. I missed it by only a couple of minutes, and it left me stranded at the airport overnight as mine was the last flight out.

Travel delay coverage can help reimburse you for unexpected expenses incurred due to a covered delay, such as meals, accommodation, and even essential toiletries.

5. Gives You Peace of Mind

Travel insurance allows you to relax and enjoy your trip without worrying about financial losses due to unforeseen circumstances. Knowing you’re covered gives you the peace of mind to focus on making memories, not managing emergencies.

In a Nutshell

Travel insurance is an investment that can save you a significant amount of money in case of unexpected events. Remember, it’s always better to be safe than sorry. Always remember to read your travel insurance plan.

This post is sponsored by Allianz Global Assistance (AGA Service Company) and I have received financial compensation. However, all thoughts and opinions are my own.